2021 Forward Guidance

Written By Philip Lockwood

While we are seeing a spike in coronavirus cases, specifically related to the more contagious Delta variant, I will look over this valley, analyze the future landscape (monetary and fiscal policies) and do the research required to make informed portfolio decisions.

It is important to remember this is not a replay of one year ago. We have vaccines and therapeutics to protect against the virus and help us if we were to contract the virus. I am hopeful that everyone takes the virus seriously and takes the appropriate requirements to stop the spread of the variant. I am hopeful the FDA approves the coronavirus vaccine and removes the “experimental” label it currently carries within the next 30-60 days. I would then expect the U.S. to reach herd immunity by November with the rest of the world reaching herd immunity in 2022. I see better days ahead and remain confident that we will have a multi-year global expansion supported by accommodative monetary and fiscal policies.

I continue to favor the economically sensitive areas of the market as we see the need worldwide to increase capacity after years of underspending to alleviate shortages and bring supply lines closer to home. I have listened to several quarterly conference calls and have noticed significant increases in capital spending on the production side of the economy, as a result of the virus and the forced innovation. I have seen enough earnings reports to know this capital spending has resulted in higher net-income and slimmer production costs as, a result of the increased technological adaptation. Production companies have seen production time shortened but inventories remain low (supported by second quarter GNP data), it will likely take until the second half of 2022 to return to normal levels.

Technology will remain a mainstay in your portfolios. I believe we are still in the early innings of a technological revolution where companies must spend to stay competitive, this spending should make those companies more cost-efficient. I remain impressed with how well corporations have navigated the challenges over the past 12 months. The companies that will thrive are coming out more profitable and generating more free cash flow than ever before, much of this related to capital spending on technology to improve net income. I expect this multi-year surge in capital expenditures on new technology to continue as companies are constantly looking to improve supply lines and bring production closer to home, as we shift to more of an environmental focus.

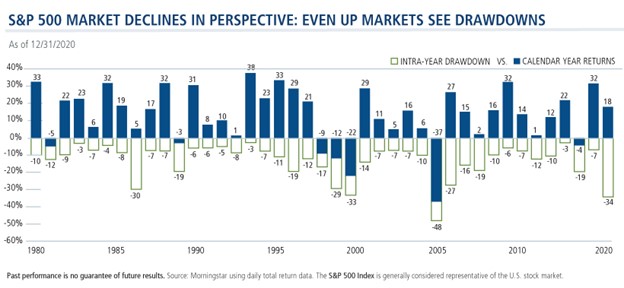

While we can always have a correction, as seen in the chart below, I believe that the conditions for the market top are not present. The government has pumped trillions of excess liquidities in the financial system, combined with accommodative monetary and fiscal policies of the fed, are a perfect setup for a continued market rally. I expect the yield curve to steepen slowly over the next year, but it is held back by massive inflows from abroad, where rates are negative.

I believe the Fed will announce this fall that it will begin tapering by early 2022 and conclude all bond-buying by the beginning of 2023. It is important to remember tapering is not tightening, and the Fed will continue to maintain its balance sheet by buying bonds as they roll off. I would expect the Fed to begin to hike its funds’ rate in 2023 at the earliest.

The Senate has approved a 1.2 trillion-dollar infrastructure plan. We will likely be waiting until fall for the bill to reach the house for a vote. This spending bill should provide a boost to heavy machinery companies like Caterpillar, John Deere and Vulcan Materials (as highlighted in my looking forward piece published in January). It should also boost raw material companies like Nucor and Ternium S.A.- both large steel producers. There will be plenty of companies that should benefit from this infrastructure plan, not to mention the additional jobs this will create, further decreasing unemployment.

The U.S. economy continues to be very strong despite shortages and supply line issues. Second quarter GNP fell short at the 6.5% (2nd quarter) annualized even as consumer spending rose by 11.8% and inventories reduced growth by 1.1%. – https://www.bea.gov/data/gdp/gross-domestic-product

I don’t see a slow down coming in this area as personal savings is close to $2 trillion in the second quarter, with an individual savings rate that remains elevated at 10.9%. At some point people will be able to go out and spend, and if the past is any indicator of the future, spending is what many will do. This will likely keep new cars, housing and travel elevated once we reach herd immunity. Couple the high savings rate with an increase in employment and I would expect certain sectors of the market to have strong tailwind support.

At the end of the day equities are the only game in town with interest rates so low and liquidity so high. Remember the adage “Don’t fight the Fed?” The Fed wants the economy to run hot. The stock market has rarely been so undervalued using Buffett’s time-tested tool comparing 10-year bond yields, currently 1.35% to the inverse of nominal earnings yield of 4.76% (https://www.yardeni.com/pub/sp500earnyield.pdf

(https://www.investopedia.com/articles/stocks/08/fed-model.asp)

Earnings season is off to a hot start with over 90% of the companies beating forecasts and raising future numbers. I am also paying close attention to balance sheets, which appear to be very strong. I expect significant increases in dividends and buybacks over the next year, which support higher stock prices specifically compared to the low yields of the counterpart, bonds.

|

PHILIP LOCKWOOD | FOUNDER + MANAGING PARTNER |

|

ADDRESS: 3100 INGERSOLL AVE. DES MOINES, IA 50312 PHONE: 515-274-8006 |

|

EMAIL: PLOCKWOOD@PARKLANDREP.COM WEBSITE: LOCKWOOD FINANCIAL STRATEGIES Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC

Securities offered through Parkland Securities, LLC, member FINRA/SIPC.

|