2022 – Fed Fight, Rate Hike and Inflations Plight

As many of you know I am a big basketball fan, and as I prepare to write the first newsletter of 2022, I am reminded of a quote by legendary coach Phil Jackson.

“It’s a great run. We’ve had a wonderful time. Time to go” –

-Phil Jackson

After shaking off a near global collapse in early 2009, the U.S. stock market is seven times higher, the 10-Year U.S. Treasury yield has fallen by roughly 3%, and gold prices have nearly tripled. Investors have been set up to win, no matter how you were allocated, investors have been set up to win, we have had a wonderful run, we have had a good time, time to go.

But…. This time is different –

Cue the loud gasp and money in the coffee can mentality. These are the headlines that drive clicks, right? Let’s list a few things experience has taught us. 1.) Historically speaking, stocks overcome any short-term downside volatility and go higher over time. (Long Term investor approach) 2.) Historically speaking, “this time is different” is the death knell for any investor (See Reason #1)

Always be present

The irony of this in an investment blog should go without saying – While most people might live in fear because they project the past into the future, the exact opposite is often true when it comes to investors in financial markets. Most investors exude overconfidence because they project the past into the future. Stocks have effectively gone up for the past 13 years, so why shouldn’t we expect stocks to continue going higher, year after year. It is important to remember, we don’t get rewarded in the present and future for past victories. We must consider what the markets have in front of us at any given moment in time and the best opportunities presented, regardless of what has taken place in the past. It is important to be present. This is what keeps an investor from buying high and selling low.

What is our present situation today?

The S&P 500 is trading near its highest valuation in history, based on a price-to-earnings ratio. The previous sentence alone is not enough to say well “things are at all time highs, it is time to sell.” As many of you know, this strategy would have you missing out on a lot of gains in previous years. (In 2021 alone, the S&P 500 made 68 new record highs) – https://www.latimes.com/business/story/2021-12-26/2021-sp-500-performance#:~:text=With%2068%20record%20highs%2C%202021%20was%20a%20year%20of%20superlatives,%E2%80%94%20the%20second%2Dmost%20ever.

The key differentiator is figuring out why the index is making all time highs, why the valuations are high, and decide if things are justified based on the market conditions and external factors. We know in 2021 we had a very accommodating federal reserve with an “easy money” policy. We had a government that was handing out money (much of which was saved) due to a pandemic, and we had many businesses with fantastic corporate earnings because they were forced (covid-19) to re-evaluate their business structure, invest in technology and get lean creating all time high net income amounts and margins. When the Federal Reserve keeps interest rates low, it encourages borrowing, growth, housing upgrades, etc. When the government hands out money and the general population is unable to spend money, (all time high savings rates – 32% in April) then we are setting up for an economic boom. https://time.com/nextadvisor/banking/savings/us-saving-rate-soaring/

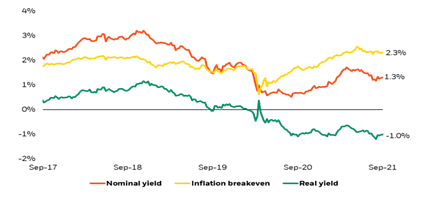

While the valuation of stocks is high from a price-to-earnings ratio, the question you must ask yourself is “what is the alternative?” In a normal situation, you would look at bonds, but high-quality bonds are trading at a negative real yield. I think to get a better understanding of this, we have to define what real yield means; the rates or yields you see on a bond like the 10-year U.S. Treasury are typically “nominal” rates. “Real” rates are the interest rates that an investor receives after adjusting for inflation—in this sense they are the “real” yield you receive from owning the asset. To illustrate, a Treasury bond that pays 5% in nominal yield per year when inflation is 3% per year would have a real rate of 2%. So, the real rate is determined by the combination of the nominal level of rates and the level of inflation.

Real yields have been pushing more and more negative

10-yr U.S. Treasury yield, inflation, and real yield.

Source: Bloomberg, as of 9/6/2021

As you can see from the chart above, money in high quality bonds have not kept up with the required purchasing power based on the low bond yields and increases in inflation. This has caused many investors to shift their investment model away from high quality bonds and increase their risk profiles to invest a higher percentage of their portfolio in equities (stocks). When there is a greater demand and limited supply, it can push the price up until supply meets demand on the curve.

Therefore, throughout the last 12-18 months, we have been looking for bond alternatives to keep your risk profile in check and give you a bond alternative.

Getting Creative with Portfolio Risk in a Low-Rate Environment

I wrote an article on this in the April 2021 newsletter – probably worth re-reading if you want to know what I am thinking with your portfolio design – https://www.lockwoodfinancialstrategies.com/getting-creative-with-portfolio-risk-in-a-low-rate-environment/ – as a quick update to this article, I have found some more cost effective ways to achieve the desired results at lower cost, opening the door to clients with less than the referenced $1,500,000 account value. The key question for 2022 – This question will determine the Federal Reserves action as it pertains to interest rates and thus which areas of the market do well and which areas pull back –

Is inflation transitory or is it here to stay?

I don’t have a crystal ball, but I can read the tea leaves as to what the Federal Reserve is thinking –

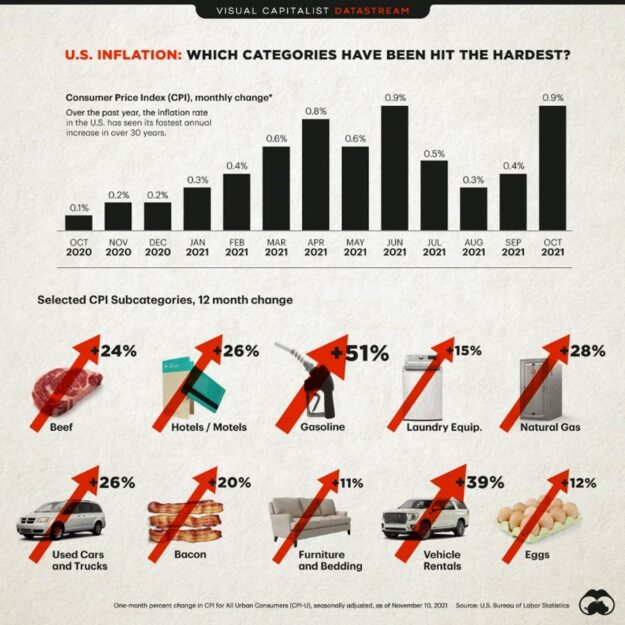

The nation’s economic steward said it will back off from using the word “transitory” to describe the fast pace of price increases, as Federal Reserve policymakers acknowledge the increasing risk of more persistent inflation

The last reading on inflation for November 2021 was an increase in prices of 6.9% vs. the same time a year ago. This is the highest such inflation reading since June 1982, nearly forty years ago. Why does this matter? Because with the 10-year U.S. Treasury yield around 1.5%, this means that investors are receiving a yield on their Treasury holdings of -5.4% after inflation, based on the latest reading for November.

But what if these recent price spikes end up continuing well into 2022? (“sustained” inflation?) Treasury investors will start wanting a much higher yield to continue lending money to the U.S. government. If Treasury yields start increasing, then the thesis for continuing to own stocks quickly evaporates, as the still positive equity risk premium for stocks, despite historically high price-to-earnings ratios quickly turns sharply negative. In other words, the peak stock valuations that have not mattered for so long would suddenly matter a whole lot.

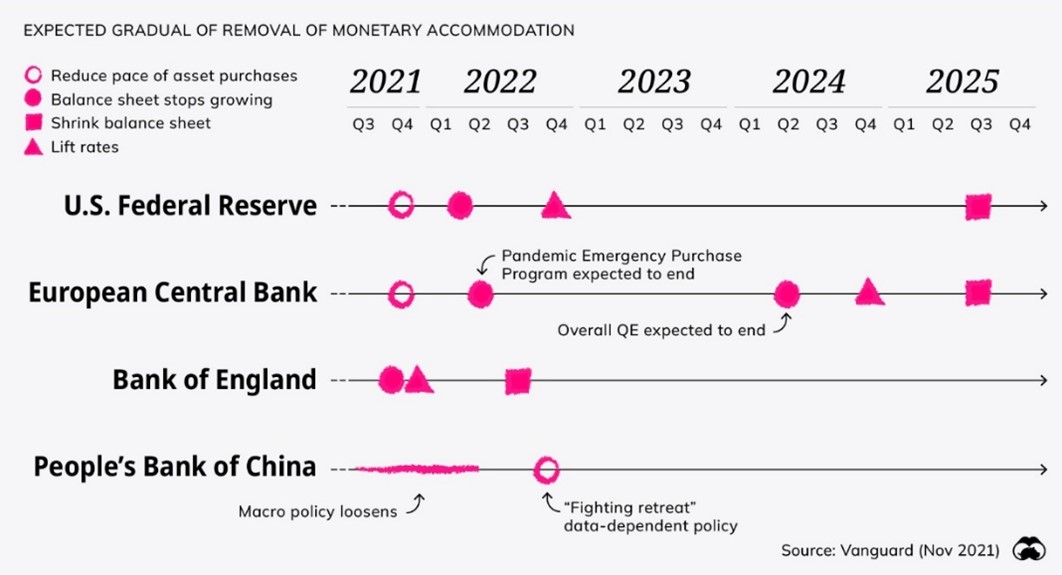

Any investor under the age of 35 probably has the thought of “even if the above is correct, the Fed will just step in and create easy monetary policy (lower interest rates) to adjust for any sort of market correction (drop of 10%+) creating growth again like they have for the past 13 years.” The difference is, the past 13 years we have been in a deflationary environment, which works hand in hand with an increasing stock market and lower interest rates. The Fed has recently shifted with swiftness toward pressing increasingly hard on the brakes in tightening monetary policy to help control inflation. In other words, the increasing rise of inflationary pressures has monetary policy and financial markets now in the direct cross currents against one another.

Depending on how constant inflationary pressures continue to be, the Fed may be forced to stay the course with a restrictive monetary policy. Given the choice between destroying the purchasing power of the broad general public or continuing to prop up the bloated asset prices owned by a small group of already wealthy investors to yet another fundamentally unjustified index all-time high, monetary policy makers are likely to choose the former over the latter in the year ahead (or at least I hope they would).

Sustained Inflation is not my Base Case –

I believe continued inflation is the biggest downside risk facing investors in 2022, I remain in the middle camp that inflation will remain elevated in the first part of 2022 but will eventually cool down as supply chain disruptions gradually resolve themselves (even with the Omicron variant currently raging) in an economy that is fading as the caffeine spike effects of fiscal and monetary stimulus increasingly wear off in 2022. I would be remised not to mention that breathtakingly high levels of sovereign and corporate debt that is inherently deflationary, particularly if bond yields start to drift higher in the coming year. I won’t put you to sleep with the analysis of the bond market 2/10 spread and 5/30 spread flattening etc. to support my view, just know there is fundamental research behind the view that supports my thesis.

Keep in mind even if my base case is correct, it does not mean that investing in stocks, bonds, and gold are all still not without meaningful risks as we enter 2022. I would anticipate the coming year may bring with it some of the most unsettling volatility, both to the upside and the downside, that we have seen in markets for some time.

Hindsight and retrospect

Of course, staying far too easy for far too long in an environment of arguably excessive fiscal policy and persistent supply chain disruptions was ultimately going to lead to a spike in inflation that would persist until the fiscal and monetary policy caffeine high finally wore off and supply chains came fully back online. The known challenge for the Fed was whether they would have the resolve to stick to their transient inflation terminology when the inevitable pricing spike came. Of course, as we have come to know all too well about the Fed, they are an impulsive bunch. I can think back to Christmas Eve 2018 – there was little to no change in the economic data, but falling financial markets over a series of days (from heavily overvalued levels) had the Fed shifting their view from further interest rate increases and balance sheet reduction to projecting interest rate cuts virtually overnight. Predictably, once the inevitable inflation spike finally arrived, the Fed lasted about two months before folding and jumping the sustained inflation bandwagon.

But as we move into 2022, this Fed unstable nature is likely to cause problems for investors. As the Fed increasingly pumps the policy breaks to fight an inflation problem that by some readings may have already been projected to eventually fade as much as nine months ago now, they risk whipsawing the economy back down into recession with an associated reduction in inflation pressures that may lag to the downside due to ongoing supply chain issues.

The market is likely to struggle with the fact that the organization with an unlimited bank account (The Fed) is no longer purchasing assets hand over fist by March, and that stocks with nosebleed valuations will be forced to finally stand naked. The fact that the financial media narrative du jour and subsequently the Fed policy directive has the potential to evolve yellow light (caution) to red light (panic) over the course of the next 12 to 18 months, is not something financial markets (including stocks) are likely to be comfortable with at all.

Before we go any further, none of this has to represent failure for investors. Instead, it can represent opportunity for those with strong stomachs that can withstand some Kingda Ka (look it up) type volatility and are prepared to find opportunity when it presents itself.

A Market full of Opportunities in 2022

As things present themselves now, inflation spiking, the fed doing a quick about face and hinting at raising interest rates 3 or 4 times in 2022, and the current elevated valuation of many stocks, I think it is a lousy set up for Large Cap Tech stocks whose valuations have soared into the stratosphere driven by the previously endless tailwinds of sluggish growth, disinflation, robust cash flow generation and easy monetary policy. This could manifest in lower (single digit) returns for many of the major indexes who are increasingly weighted by a smaller number of stocks.

*2020 Chart of the weighted composition of Nasdaq 100

Instead, I see the market set up as attractive for several other stock sectors. If you look at current price-to-earnings valuations health care looks attractive along with biotech. I also think consumer staples looks, energy, and industrials look attractive. There may still be opportunity in large-cap tech, but I believe the opportunity won’t present itself until after a repricing as a result of interest rates climbing.

I have been spending the first week of January digging for future opportunity as we turn the page to 2022. I have made some changes in many of your accounts to accommodate areas of opportunity I see in 2022. These are not wholesale portfolio changes, but adjustments to continue to try to achieve the goals we have set forth with each of your plans. I want you to take care of yourself, do something you have always wanted to do, and spend each day making the lives of others better for having met you. I know it doesn’t follow the above trend with the basketball quotes but I will leave you with one of my favorite quotes as you start towards YOUR 2022 –

“Service to others is the rent you pay for your room here on earth.”

– Muhammad Ali

Go out and improve yourself, improve others, do something great, take a chance and make the world a better place.

|

PHILIP LOCKWOOD | FOUNDER + MANAGING PARTNER |

|

ADDRESS: 3100 INGERSOLL AVE. DES MOINES, IA 50312 PHONE: 515-274-8006 |

|

EMAIL: PLOCKWOOD@PARKLANDREP.COM Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC Securities offered through Parkland Securities, LLC, member FINRA/SIPC. |