A Drunken Walk Home

Written by: Philip Lockwood

It has been a brutal week for the markets but this is why we invest for the long term – I wanted to get a piece out sharing my thoughts on the current market conditions including where I think things are going in the next 18 months or so.

A few quick items to help provide ease for those that are uneasy when we see corrections in the indexes (Nasdaq in this situation).

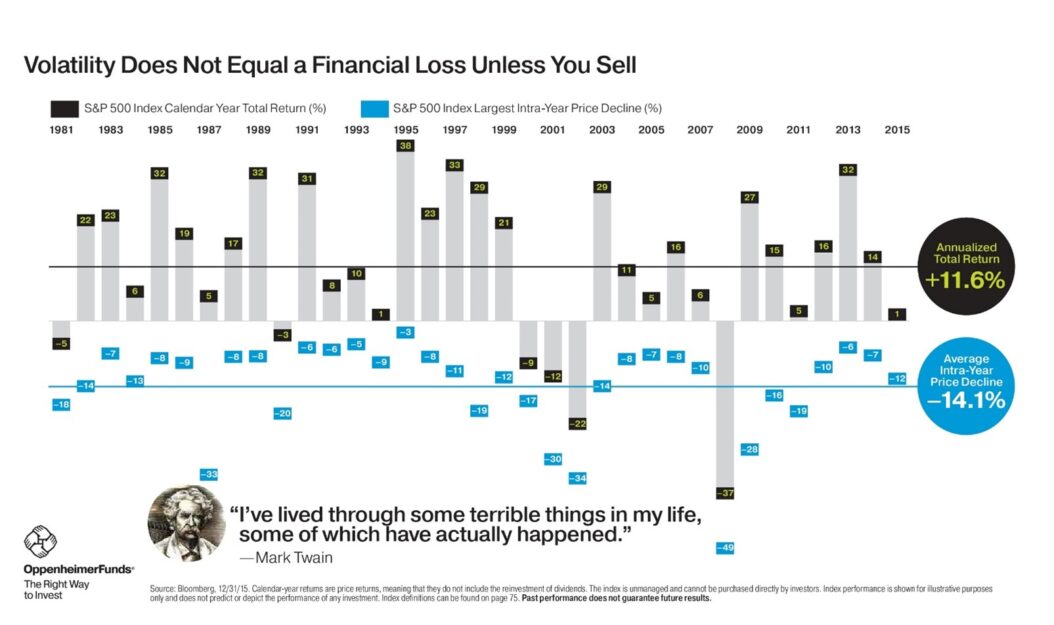

This chart is a little dated, but you can see the average intra year decline of the SP500 from 1981 to 2015 was 14.1%. The annualized total return for the same time period was 11.6%. As the Philadelphia 76er’s would say, it is important to “trust the process”.

On to our current environment and what is affecting markets today

Stimulus does exactly what it is supposed to do, it stimulates the economy. It would appear the last few rounds of stimulus have been going out too many people who really don’t need the money, so they are saving it or investing it. When the money is saved in savings accounts, checking accounts, etc. the savings rates increases, and the banks go out and buy some sort of short maturity or low risk security, like treasury bills or treasury notes. Historically speaking, this would lead me to think that the 10-year yield would actually end up decreasing over the course of the next 18 months because of the inflow of additional savings. (This is a contrarian view to what you will hear from the mainstream media.)

The 10-year yield is important because as that increases, it gives investors other options instead of being in equities. It also creates a scenario where companies are being revalued based on the fixed alternative option. When fixed rates are low, they are unattractive, and investors look for other options (equities). When rates are high, then the equity alternative is more appealing and the future values, we assign to companies decreases based on the alternative option. (This would cause a decrease in equity values as 10-year rates increase).

I am not in the predictive business, but I am a historian and as we look at federal funds rates over the last 25 + years we can see that there is a downtrend in rates.

Source: Guggenheim Investments, Bloomberg. Data as of 2.5.2021

Being from the Midwest and getting over a brutal winter, I think it is relevant to liken the movements of rates to a drunken man walking home in the snow. He gets his left foot down and right foot down, step after step, with no real pattern as to where his next foot will land but eventually, with enough steps, he will get to his front door.

This is how I would view the current 10-year treasury yield. I cannot predict the next few steps, but in general, I believe eventually the trend seen above will continue. While rates are currently increasing creating a market downturn, at the end of the day (18 months and a few stimulus bills later) the 10-year rate will continue its downward trend, creating opportunities in equities. Historically speaking, the last 6 months of a bull market have provided the largest gains. To quickly recap all of the money being put into the economy we currently have:

- The Federal Reserve has committed itself to a 0% interest policy until 2022/2023

- The Treasury is spending money hand over fist

- Congress is about to approve a large 1.9 Trillionish dollar stimulus package

- Congress will follow this spending with an infrastructure bill which could be to the tune of 2 trillion dollars

There just doesn’t seem to be an end in sight for the amount of stimulus in the economy. As long as I am correct and long term rates continue to go down, equity values should receive support, housing should continue to do well and people will continue to drive up prices of different things like art, baseball cards and other collectibles. The real question at the end of the day, is how does all of this end? After all, we are adding 4 to 5 trillion to our national debt with the above referenced congressional actions. This is the conversation that you need to be having with your financial advisor. If you want my take on actions you can take now.

Disclaimer: I am only giving my thoughts and opinion. Each person’s investment risk and time horizon are likely very different, and you should talk with your financial advisor before making any decisions. This article is my opinion only, and in no way should be taken as a directive or advice.

|

PHILIP LOCKWOOD | FOUNDER + MANAGING PARTNER |

|

ADDRESS: 3100 INGERSOLL AVE. DES MOINES, IA 50312 PHONE: 515-274-8006 |

|

EMAIL: PLOCKWOOD@PARKLANDREP.COM WEBSITE: LOCKWOOD FINANCIAL STRATEGIES

Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC

Securities offered through Parkland Securities, LLC, member FINRA/SIPC. |