Finally: Attractive Rates for Cash, CDs, Money Markets and Alternatives

Written by Philip Lockwood

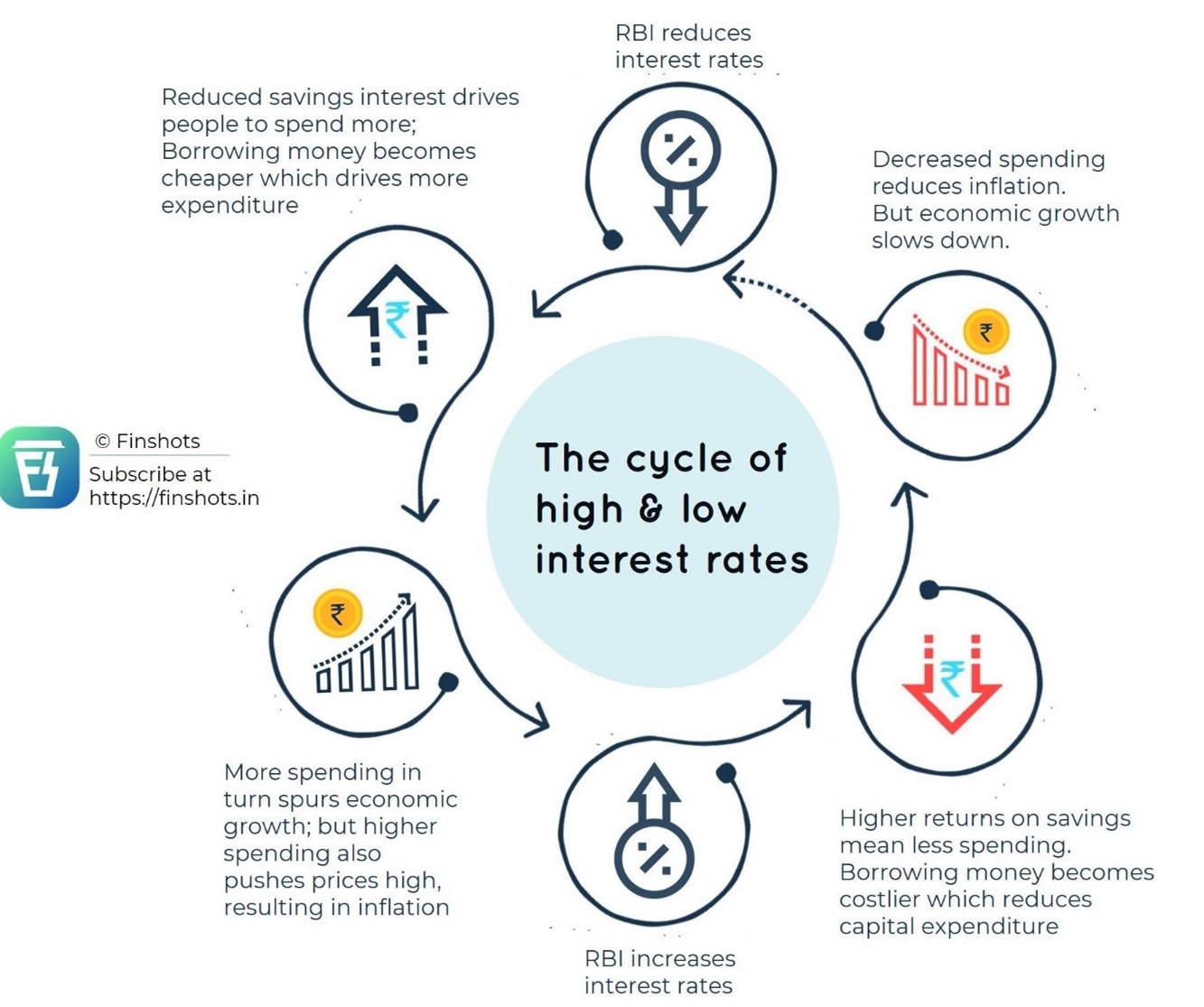

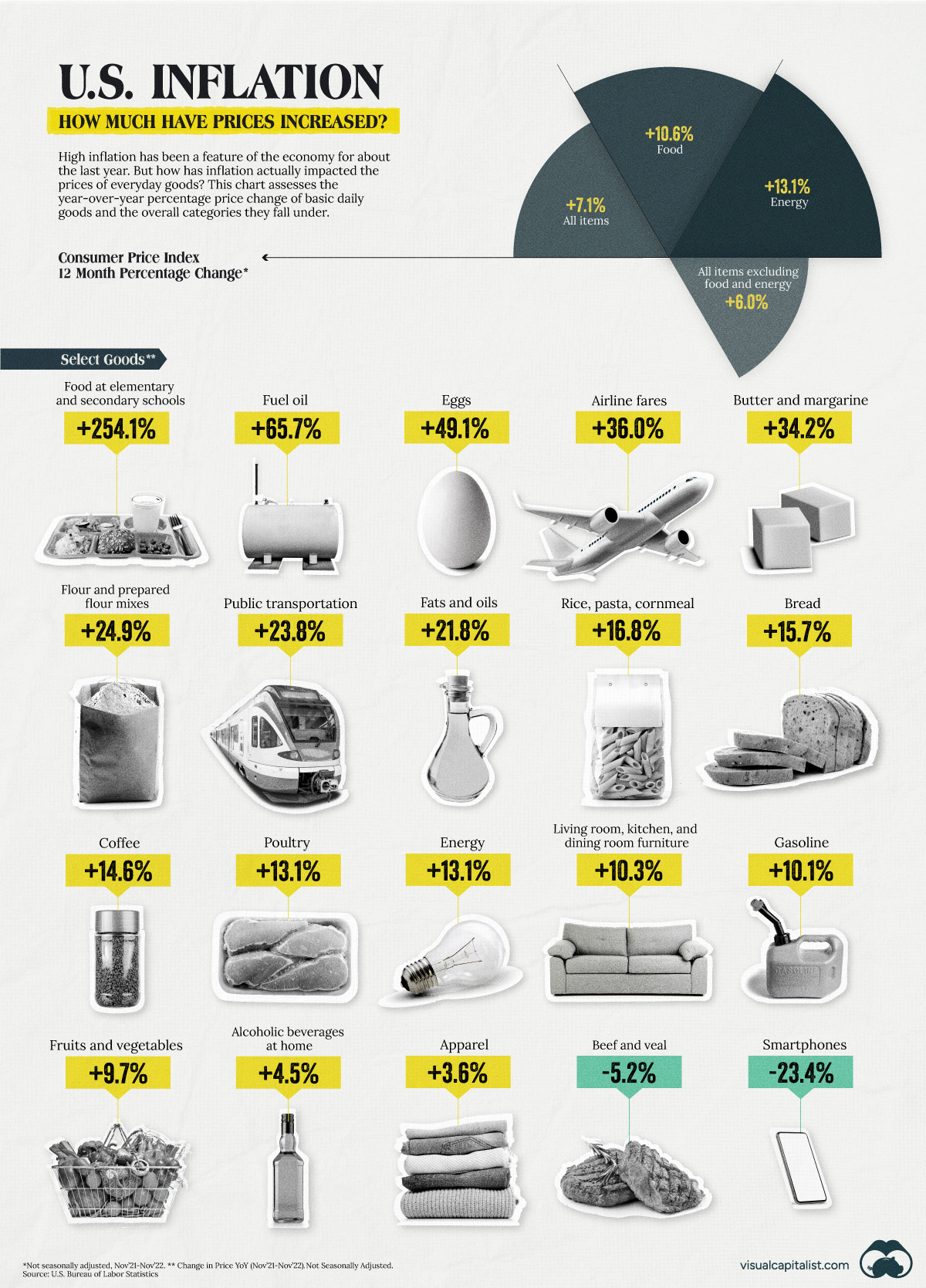

Higher Interest rates are rarely a good thing, especially if you find yourself needing to borrow any money. Interest rates on homes, cars, business loans, etc. tend to go higher. Higher interest rates also tend to usher in lower stock market returns as the cost of capital has increased for businesses. Higher interest rates are normally coupled with higher inflation as one way to fight higher inflation is to slow growth/demand, and one way to slow growth/demand is to raise interest rates.

One of the benefits of higher interest rates can be higher rates earned on your fixed income investments. Many of the common banking instruments are also paying higher rates, I am sure you have noticed higher rates in your savings accounts and higher offers for CD’s. The one thing I would encourage against is running out and locking in a 12 month + CD with a majority of your free cash. There are a few different reasons why:

- The Federal Reserve is likely to continue to raise rates over the next few months in an effort to control inflation.

- There may be better alternatives for your cash, depending on your time horizon.

- The main money market I use is FDRXX which currently has a 7-day yield of 3.98% (as of 1/30/23) and best of all, you are not tied into any sort of long term time horizon as you are with many of the 12-48 month CD options – https://fundresearch.fidelity.com/mutual-funds/view-all/316067107

- There are additional options beyond just money markets, CD’s, etc. as T-Bills/T-Bonds are now looking more and more attractive.

If you have any questions about options for your money, feel free to reach out. I am more than happy to discuss the current rate environment and what might be the best option for you right now.

|

PHILIP LOCKWOOD | FOUNDER + MANAGING PARTNER |

|

ADDRESS: 3100 INGERSOLL AVE. DES MOINES, IA 50312 PHONE: 515-274-8006 |

|

EMAIL: PLOCKWOOD@PARKLANDREP.COM WEBSITE: LOCKWOOD FINANCIAL STRATEGIES

Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC

Securities offered through Parkland Securities, LLC, member FINRA/SIPC. |