Morning Update 3-16-20

What a Sunday night! I went from listening to the VP layout a ground strategy for more effective testing to jumping on a Conference call hosted by Jerome Powell (The Federal Reserve Chairman). In that call they cut benchmark interest rates to zero and implemented a bond-buying program of at least $700 Billion dollars. We all know the Fed can’t do anything to stop the virus but the action they took on Sunday should add liquidity to the treasurey and bond markets and provide some monetary stabilization. Enough of the fancy talk, at the end of the day the decision by the Federal Reserve should encourage banks to continue to lend during this trying time. They should be open to lending to the small businesses who have to shut their doors for a period of time. I don’t think you will find anyone who would argue that the second quarter will be very weak. The 3Q and 4Q will depend on the virus and how quickly we are able to get rid of it. The most important step now will be for Congress and the President to agree on a fiscal stimulus package to help small business, hourly employees and everyday citizens. This will certainly be a trying time with plenty of market volatility (Large single day Market moves in both directions). It will be important to remember your long term goals. I don’t believe I have a client that will need their full investment account balance in the next 12 months. A majority of my discretionary clients have had larger than normal cash holdings and will continue to too provide short term liquidity if needed and to search for future buying opportunities as we find out more details on the virus’s effect on the economy. While moments like this are undoubtably uncomfortable it is important to remember markets do come back. We have seen a historic deceleration of the market over the past 30 days. Ben Carlson put together a fantastic chart showing some of the largest market draw downs and how long it has taken to break even. If you notice the last two drawdowns have taken just 4 months to come back and set new highs.

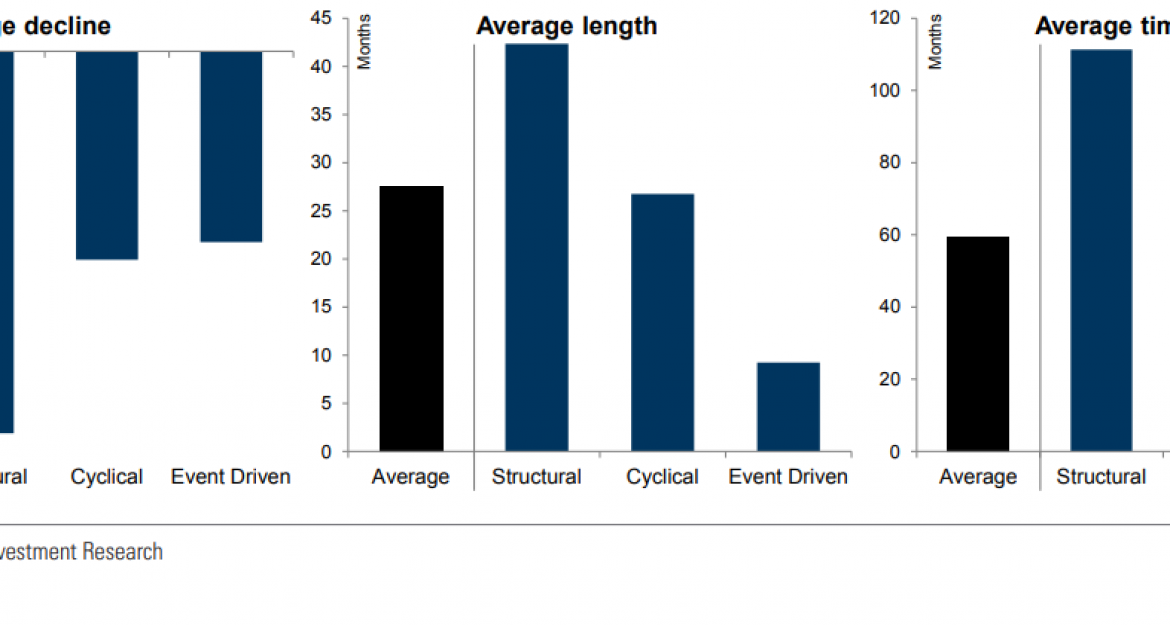

As I have discussed in previous posts this recession can be described as an “Event Driven” recession (with the event being the Coronavirus). As you can see from the Goldman Sachs Global Investment Research team event driven recessions tend to be the shortest and rebound the fastest.

Goldman Sachs U.S. chief equity strategist David Kostin, thinks that the S&P 500 will likely head lower over the next three months as a result of the economic fallout from the spreading coronavirus deepens. Kostin did deliver a measure of hope, reiterating his stance that V-Shaped recoveries in stocks usually follow “event-driven” bear markets. He expects the S&P 500 to end 2020 at $3,200. There are many factors and variables at play with this black swan event. It is important to have a plan and implement that plan over time. If anyone would like to discuss their account or the plan we are currently implementing I will make myself available anytime to chat day or night. You can reach me on my cell phone at 515-867-4342.

| Philip lockwood | Founder + Managing Partner |

| Address: 3100 Ingersoll Ave. Des Moines, IA 50312

Phone: 515-274-8006 |

|

Email: Plockwood@parklandrep.com Website: Lockwood Financial Strategies Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC Securities offered through Parkland Securities, LLC, member FINRA/SIPC.

|

It’s important to remember that past performance does not guarantee future results. Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type