The Year of the Bear (Fear, Panic and Pessimism)

Written By Philip Lockwood, October 2022

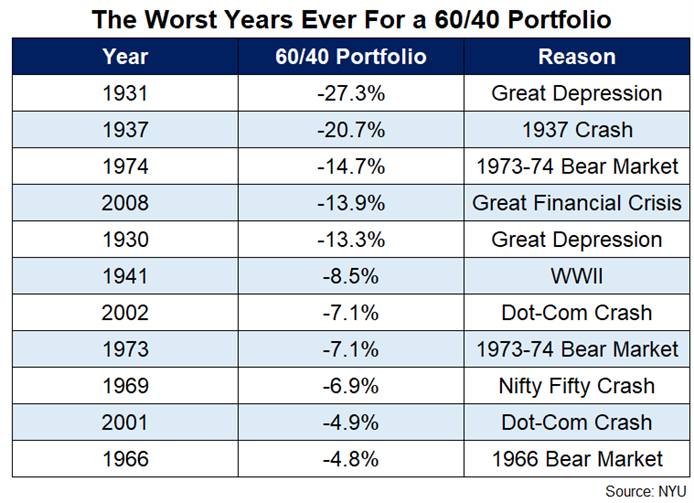

This has been a year that has tested the resolve of all financial professionals and their clients. During the first half of the year, we saw the S&P 500 produce its worst return since 1970. Compounding the issue, there was also a dramatic decrease in bond funds, making it one of the worst years for a portfolio- holding 60% of the portfolio in stocks and 40% in bonds. The thinking used to go, you get the best of both worlds: high growth potential from your riskier stocks and protection from your more conservative bonds. I have been discussing the potential downfall of the 60/40 portfolio with clients for the better part of the last 24 months. I think there are more efficient ways to diversify a portfolio’s risk as we head into a different economic environment….more on that later.

Investors who had a 60/40 portfolio invested in line with benchmark U.S. stock and bond indexes shed 20% of their value this year. Only two calendar years – both during the Great Depression – have been worse.

Factor in rising prices, and things get even darker. “On an after-inflation ‘real’ basis, this is currently likely to be the worst year ever for a traditional 60/40 stocks and bonds portfolio,” tweeted Meb Faber, co-founder and chief investment officer at Cambria Investment Management.

Why isn’t the 60/40 portfolio working?

The portfolio is designed in such a fashion to take advantage of economic growth (stocks), and hedge the risk of lack of economic growth (bonds). Normally stocks and bonds are negatively correlated, meaning investors have largely been able to rely on their bond investments for protection when equities sell off. That is not the case this year. As I wrote about at the beginning of the year, the Federal Reserve had to raise rates to fight inflation. In full disclosure, the rate rise has been faster than I ever anticipated and in fact has been the largest six-month increase to interest rates in 41 years. (https://www.cnbc.com/2022/09/23/what-to-do-with-your-money-during-rising-interest-rates.html)

The rapid rise in interest rates has forced down bond prices. Bond prices and interest rates move in opposite directions. Bonds offer a fixed coupon rate (Example: Apple could release a bond paying a coupon rate of 4%, which would have been pretty attractive when CD’s and other fixed interest instruments were paying a rate under 1%) As the Federal Reserve raises their rates, other fixed interest rates tend to rise, making a 4% yield look much less attractive than new bonds issued at higher rates, or even CD rates who as of the time of this article are paying as high as 3%. This is why at the time of writing, the broad bond market has fallen more than 14% from when the year began.

All hope is not lost –

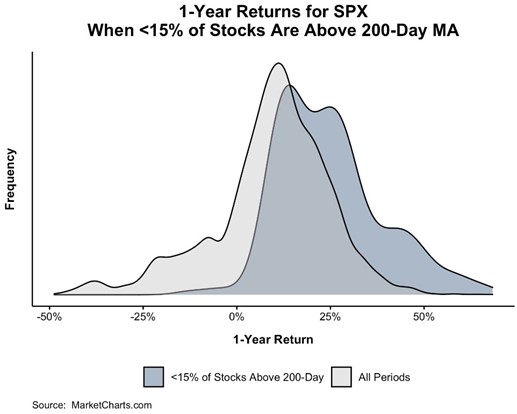

The last quarter was abysmal for stocks. Whether you were looking at prices or people’s reaction to prices, it was hard to find anything positive to say. Could things be so bad they are actually good? Hear me out, because I know this sounds silly, but its not. It’s the truth. The riskier stocks feel, the less risky they get over time. I cannot emphasize “over time” enough. We know sometimes stocks fall significantly and then they crash, but full-blown crashes are not common, and while it’s important to be aware of them, they should certainly not be your base case. Every bear market does not lead to a global crisis. Last week, less than 85% of stocks in the S&P 500 were above their 200-day moving average. This has happened 219 times since 1987, with most of these periods grouped together. The only time returns weren’t positive one year later, was September of 2001, and October 2008- that is it- two times out of 219 happenings.

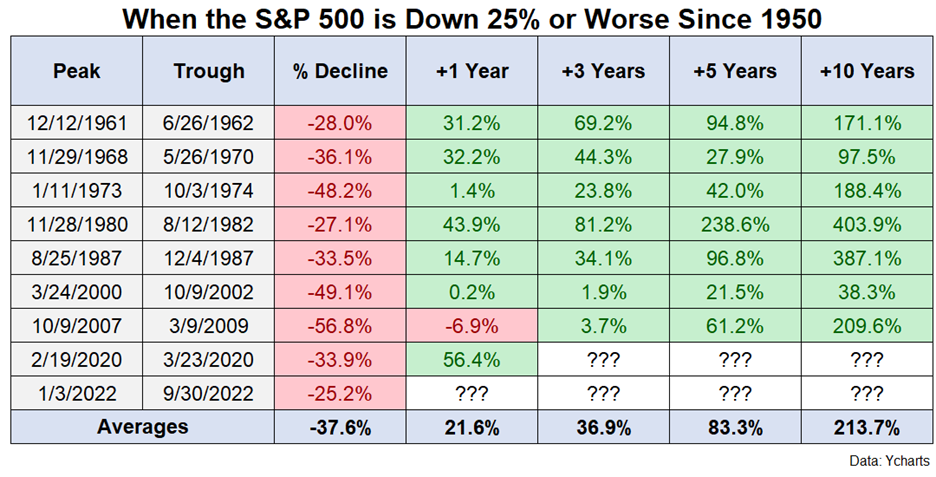

The Federal Reserve has indicated it will continue to raise rates in an effort to slow growth and bring down inflation. We are in a mid-term year and inflation is still running hot. I am in no way saying we have seen a market bottom, but I am saying when the S&P 500 is down more than 25%, you normally want to buy and certainly don’t want to sell out of the market as a whole. You can see the 1-Year, 3-Year, 5-Year and 10-Year results in the chart below.

Every Bear Market has two things in common:

- They eventually end (although never soon enough)

- Expected returns go up

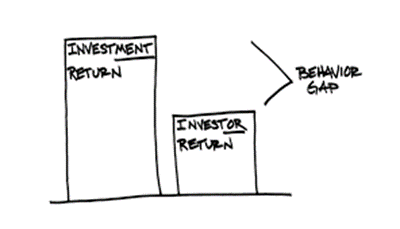

The first item seems obvious. The second should be obvious, but is overlooked by many of the investing public. When I say expected returns go up as stock prices fall, it is an overly simplistic way of saying that investors are paid for what stocks do in the future. Stocks are not valued by what they have done in the past, and history tells us that as stock prices get lower, both in absolute terms and relative to their valuations, the opportunities to make money in the future increases. If we let emotion take control, it often seems like the opposite would be true – when we experience losses, we are more likely to think additional losses are coming. This is because of the presence of risk and is human nature baked into our psyche. One of my mentors has a drawing for this type of behavior and I have included it below as a simple reminder of what this line of thinking leads to.

When investors let the emotion/fear take control of a well thought out plan they end up with something that looks more like this:

If you can take the emotion and fear out of the situation, most investors/clients are good at understanding that you want to buy low and sell high. This goes for anything- stocks, real estate, bonds, etc. Buying low means taking less risk that the purchases we are making will be foolish ones. The investment may or may not appreciate in price, but the better value I can buy it for, the less risk I have that it will go substantially lower in price. Buying stocks when the prices are falling is both less risky and carries with it a higher probability of eventually making money. I know it never feels like that in the moment, but it is empirically true. If you are retired and no longer putting new money to work for you, the same principle applies about holding true to your investment allocations and plan.

Therefore, we develop a plan and implement that plan over several years. I don’t have a single client that is in this process for a 12-month period. They wouldn’t be a client if that were the case. Historically speaking, 1 year does not make a fortune or break a fortune, as long as you stick to the plan. Your original investment portfolio was designed for you and your goals. Now is the time to remember your overall goals and objective of your portfolio. I have designed your asset allocation to be followed over the course of many years. You can’t abandon it because it’s not working in the short term.

With an understanding of the current market environment (Fed Raising Rates and High inflation) I will be making changes to portfolios to accommodate the market environment as I often do, making changes to investments to help accommodate what I believe to be the current market conditions. This is one of the things you pay me to do. This in no way indicates a fundamental change in philosophy or a long-term change in your financial plan.

My job during times like this is to keep you focused on the plan and help talk you off a ledge if necessary, while everyone around you reacts to the latest panic and pessimism of the present. If history has shown me anything, you will thank me in a few years.

|

PHILIP LOCKWOOD | FOUNDER + MANAGING PARTNER |

|

ADDRESS: 3100 INGERSOLL AVE. DES MOINES, IA 50312 PHONE: 515-274-8006 |

|

EMAIL: PLOCKWOOD@PARKLANDREP.COM WEBSITE: LOCKWOOD FINANCIAL STRATEGIES

Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC

Securities offered through Parkland Securities, LLC, member FINRA/SIPC.

|