What’s New With Social Security: 7 Topics to Watch in 2024

1. 2024 Cost of Living Adjustment

Social Security paid a substantial cost-of-living adjustment this year. The cost-of-living adjustment for 2024 is 3.2%. The latest 3.2% COLA pales in comparison to last year’s 8.7%. But that was an anomaly. Since 1989, the COLA has averaged about 2.6% a year. The Social Security trustees project a 2.4% COLA going forward.

2. 2024 Earnings test

The earnings test threshold is affected by the cost-of-living adjustment. As you probably know, if you are under full retirement age, and you work and receive Social Security benefits, part of your benefit may be withheld. They withhold $1 for every $2 you earn over the threshold, which went up to $22,320 this year, compared to $21,240 last year. If you earn less than $22,320, none of your benefits will be withheld. If you are under full retirement age and have the opportunity and ability to work, it’s probably better to earn as much as you can and delay applying for Social Security.

3. Social Security taxes (payroll taxes and income taxes on benefits)

The maximum earnings subject to Social Security tax went up to $168,600 from $160,200 last year. This means higher earners will pay Social Security taxes on more of their earnings. But remember that Social Security taxes represent a pretty good investment in the form of inflation-adjusted income that lasts for life. The more earnings you have, and the more Social Security taxes you pay, the higher your benefit will be. The Medicare tax also did not change. It’s 1.45% on all earnings. Here’s the math. If you earn the maximum of $168,600 in 2024, you will pay $10,453.20 in Social Security taxes. If you’re self-employed you’ll pay both the employee’s and employer’s share of the tax, or $20,906.40.

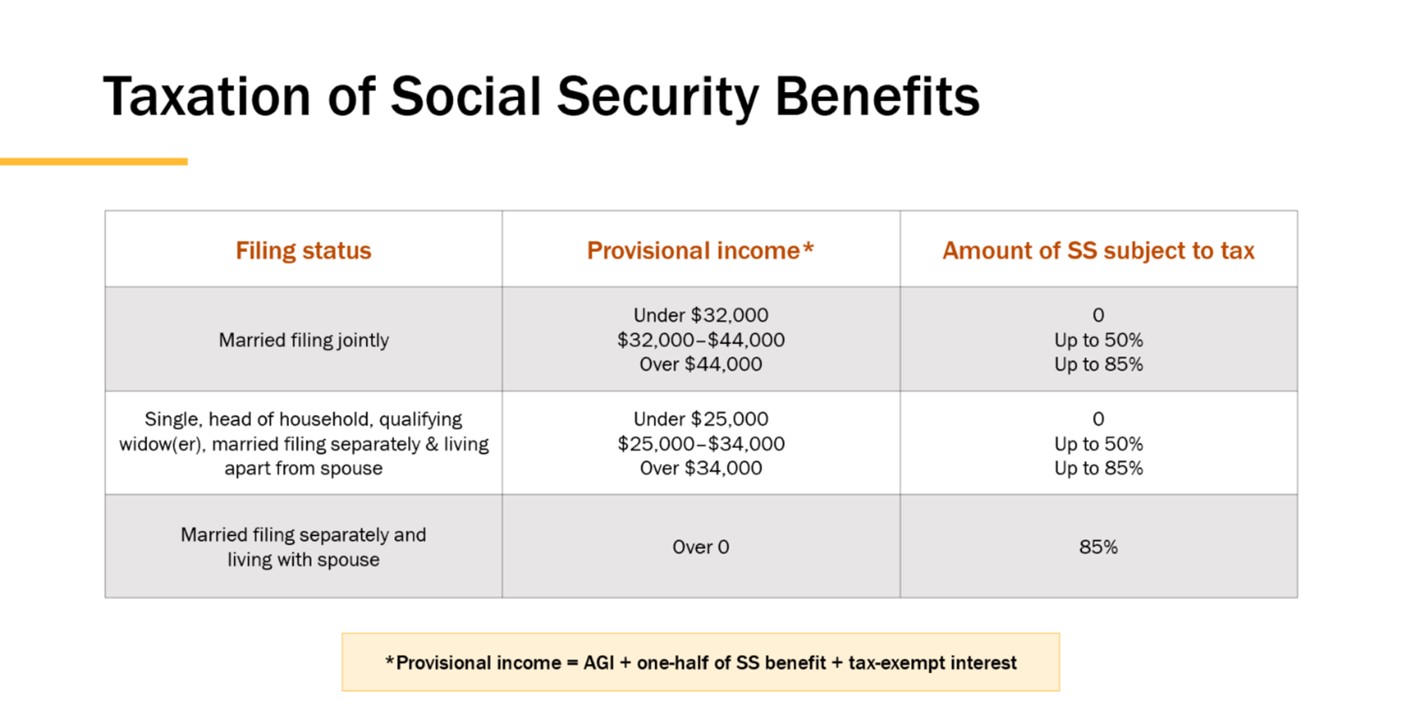

4. Taxation on your social security benefits

5. 2024 Medicare premiums

The base Part B premium is now $174.70 per month. This is up from $164.90 last year.

Even if the base premium is lowered, some people will pay more due to the income related monthly adjustment amount, or IRMAA. If you are on Social Security and have your Medicare Part B premium deducted from your Social Security benefit, there is a hold-harmless provision that keeps your check from going down if the Social Security cost-of-living adjustment doesn’t cover the rise in the Part B premium.

This year, the Social Security COLA was 3.2%, while the Part B premium went up by 5.9%. In most cases the dollar amount of the COLA more than covered the increase in premiums, so the hold harmless provision does not apply. The issue that will be affecting more people is the income related monthly adjustment amount, or IRMAA, applied to their Medicare premiums. The IRMAA is an extra premium you must pay if your modified adjusted gross income exceeds certain thresholds. In 2024 the first threshold is $103,000 if you are single or married filing separately, up from $97,000 last year. For married couples the first threshold is $206,000, up from $194,000. MAGI for this purpose is adjusted gross income plus tax-exempt interest.

Your premium each year is based on the tax return you filed two years prior. So, if you are on Medicare, your 2024 premium is based on the income you reported in 2022. But if your income has changed due to a specific life-changing event, such as retirement, you can appeal. In other words, if you reported high income in 2022 and you have since retired, you can appeal the higher premium. Please note that a one-time capital gain is not grounds for appeal. In other words, if your 2022 tax return shows high income because you sold an asset in that year, you will have to pay the higher premium in 2024. But if your income has gone back down in 2023, your 2025 premium will be lower.

6. Status of Social Security trust fund and reform proposals

Social Security was designed as a pay-as-you-go system. Payroll taxes from current workers go into a trust fund and are immediately paid out to current retirees. Because baby boomers have been in their peak earning years, the trust fund has accumulated more than needed for current benefits. Right now, the trust fund holds about $2.8 trillion, which is invested in special-issue Treasury securities. As baby boomers start retiring, these trust fund assets will gradually be drawn down. Over the next 75 years, costs will begin to exceed income. There are enough reserves that the system will be able to pay 100% of promised benefits until 2034. After that, if nothing is done to reform the system, income will be sufficient to cover just 80% of promised benefits. Although the Social Security system is not in imminent danger, most people agree that the earlier reforms are instituted, the less painful they will be on everyone. It’s really just a math problem that involves an increase in revenues, a cut in benefits, or a combination of the two. Here are just a few of the ideas that have been proposed:

One is to increase the maximum earnings subject to Social Security tax. Currently, $168,600 in earnings are subject to the 6.2% tax paid by you and your employer. One way to shore up the system is to raise the earnings cap or eliminate it altogether.

Another reform proposal calls for raising the full retirement age. Currently, full retirement age is 66 for people born between 1943 and 1954, and 67 for people born in 1960 or later. An argument in favor of raising the retirement age is that people are living longer. An argument against it is that people whose occupations involve hard physical labor really can’t work until age 70.

Still another reform proposal would change the benefit formula so that future increases would happen at a slower pace. This would affect the benefits of future retirees.

And some are talking about changing the formula for cost-of-living adjustments. This could give retirees smaller benefit increases going forward, although the changes are expected to be minimal. Given that there are lots of ways the Social Security system can be reformed, is Congress likely to address the issue this year? Probably not.

Other issues are taking priority, and because of that $2.8 trillion trust fund, benefits are not in immediate danger. The last time Congress made major changes to the Social Security system, in 1983, the trust fund was within a few months of running out of money. Theoretically, Congress has until 2034 before they have to worry about that happening.

7. Update on Social Security claiming strategies

If you would like a Social Security checkup, we may be able to help you identify possible benefits, explore claiming strategies, and see how Social Security fits into the rest of your retirement income plan.

This article is provided for informational purposes only and should not be construed as tax advice. Consult your tax professional.

Philip Lockwood | Founder + Managing Partner

Address | 1501 Ingersoll Ave Ste 201 Des Moines, IA 50309

Phone | 515-274-8006

Email | plockwood@parklandrep.com

Website | Lockwoodfinancialstrategies.com

Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC

Securities offered through Parkland Securities, LLC, member FINRA/SIPC.