Note to Clients

Written by: Philip Lockwood

2/24/22

As things look grim in Ukraine this morning, my prayers go out to the Ukrainian people. My wish is for zero casualties, but I am realistic as to the toll that war takes on a country. Mornings like this remind me of a great quote by Dwight D. Eisenhower when he said, “I like to believe that people in the long run are going to do more to promote peace than our governments. Indeed, I think that people want peace so much that, one of these days, governments had better get out of the way and let them have it.” With that being said, I want to head off questions as to my thoughts of the current situation and market environment as it pertains to your portfolios.

History would lead me to believe that there tends to be an overreaction in the stock market when something like this happens. We have a few unknown variables moving forward and things I will address in this quick memo. The writing has been on the wall for this situation over the past few weeks. This is why we have taken a larger stake in Energy Stocks and in some account’s commodities. I believe the two biggest financial areas of impact will be to the oil market and wheat market, hence the shift in some of the above allocations. The next question to ask is how long do we think the war will last? The west has said it will not allocate troops to help Ukraine but instead will act via sanctions on Russia. This leads me to believe it will be a relatively short war, with what I hope would be limited casualties in comparison to past wars. Ukraine without troop assistance from its’ allies will be overmanned and out gunned. Once the market overreaction happens, I think there will be plenty of opportunity in companies with large amounts of free cash flow, which appear to be undervalued, based on a price to earnings ratio. One area that could be affected almost as a double whammy would be the chip sector (Semi-Conductors). Ukraine supplies more than 90% of the U.S. semiconductor-grade neon, the double whammy being this and the supply chain issues we have seen because of of Covid-19 shutdowns.

The economic environment is not providing a tailwind as higher inflation and federal reserve tightening tends to lead to slower economic growth. GDP was a great number today, but this is a backward-looking number. Future forecast for GDP will likely be lower in the near term. With that being said, we have been in a downward trend in the market for some time and while I don’t expect to see double digit returns inside the indexes as the norm for the next couple of years, I think the indexes can still average positive growth.

If the above proves to be accurate, the other concern will be the Federal reserve and what will happen to the interest rate in March. Will the geopolitical risk detour the Feds rate increase, or at a minimum, the amount of the March increase? Will it be 0, .25. or .50 bps? Normally when the Fed raises rates, the higher multiple companies that tend to bleed cash based on their business model (high research and demand) budgets tend to not do as well and companies that qualify as a “value” company, tend to do better. The technology sector has had a swift fall from grace, which I believe can provide some individual opportunities moving forward, but with the Fed increasing rates it will be important to monitor the individual equity selection process. – If you are in for a longer read I would encourage you to read my blog post from January 8th – Fed Fight, Rate Hike and Inflations Plight

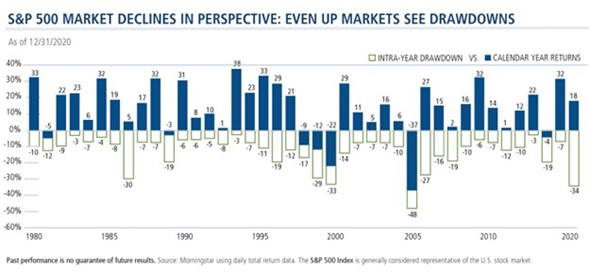

As always, if you are a Fidelity advisory client of mine, you have a plan with a more active portfolio management philosophy, a portfolio that strives to look for opportunities in times like this. I will remind everyone that market pullbacks are not unheard of and not a reason to panic.

Remember to stay the path, monthly distributions will continue and while we will likely see a short-term increase in inflation, breathe and continue doing what you enjoy doing on a day to day basis.

|

PHILIP LOCKWOOD | FOUNDER + MANAGING PARTNER |

|

ADDRESS: 3100 INGERSOLL AVE. DES MOINES, IA 50312 PHONE: 515-274-8006 |

|

EMAIL: PLOCKWOOD@PARKLANDREP.COM Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC Securities offered through Parkland Securities, LLC, member FINRA/SIPC |